Clutch

At Clutch, we specialize in transforming Credit Unions into forward-thinking FinTechs. We utilize their solid financial foundations to provide responsible lending and deposit account creation for millions across America. For this project, I led the design of the Staff Portal. I worked closely with product, engineering, and Credit Union staff to understand their needs and design a solution that supports their day-to-day lending workflows.

Jun, 2023

COMPANY

Clutch

Framing the problem

Before designing the Staff Portal, we spent time uncovering where Credit Union staff were experiencing the most friction in their day-to-day workflows. Through interviews and feedback sessions, we identified the main challenging areas.

Offer finalization & Cross Sell

Finalizing offers was time-consuming and often required offline workarounds

Our goal

The goal is to give frontline staff a simple, modern tool to handle loan applications faster and with more confidence. With direct integration into the Loan Origination System and a FinTech-grade interface, staff can submit and track applications seamlessly in real time.

Staff can manage applications in one place without duplicate data entry.

Quick access to offers helps guide customers to the right choice.

The system highlights relevant additional products.

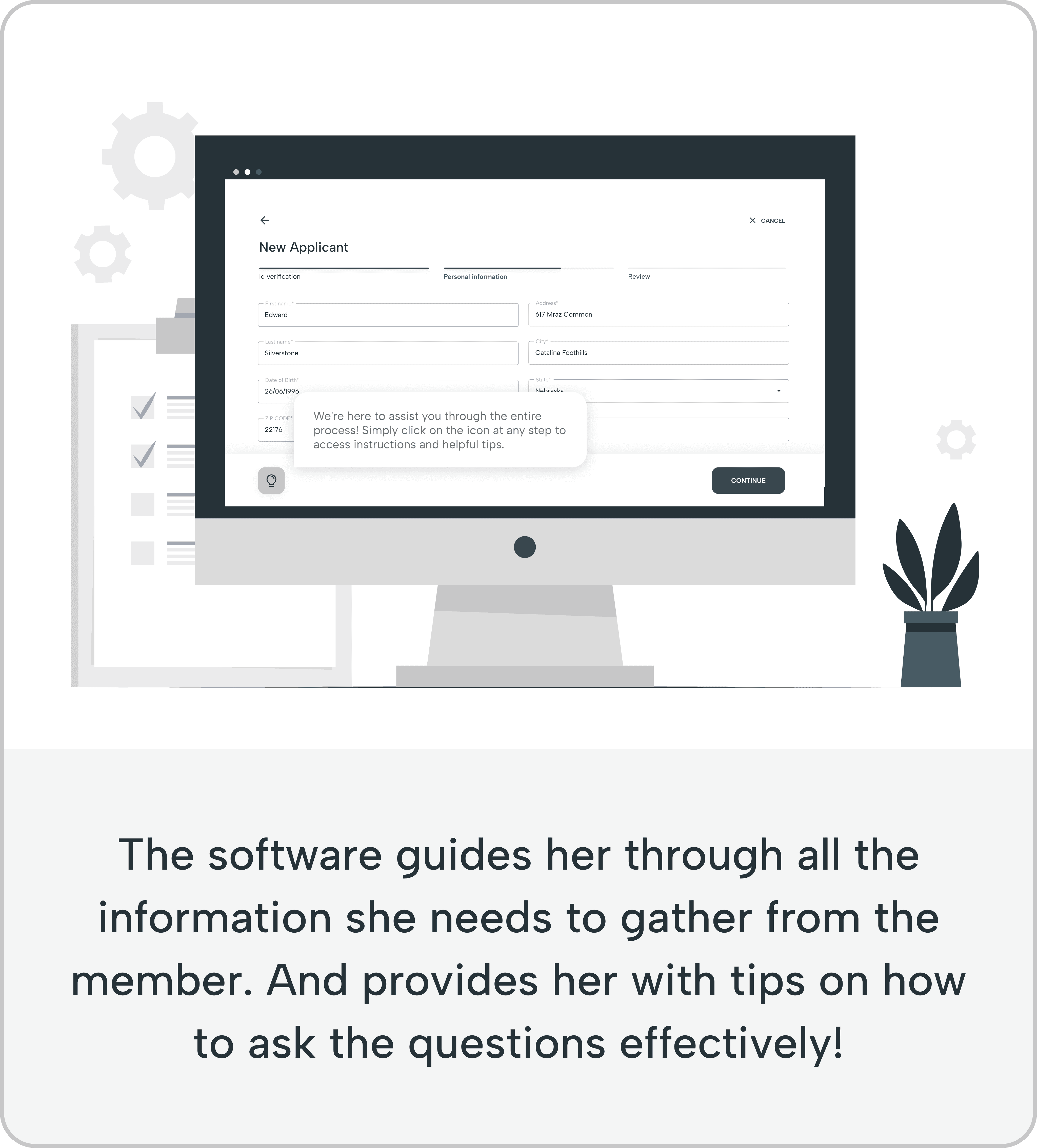

To illustrate the experience from a branch officer’s perspective, I created a storyboard to visualize their journey and better understand the real-world context and challenges faced by new branch officers.

Research

Before diving into design, I reviewed past research conducted with staff members from multiple Credit Unions. This included interview notes, usability sessions, and feedback collected from both branch and call center employees.

In addition to reviewing internal research, I conducted a benchmark analysis of tools used in similar contexts, including consumer lending platforms.

Jobs to be done

To better define opportunities for design, I mapped out Jobs to Be Done based on user interviews, support tickets, and past research across different credit unions. Understand which needs were unmet or only partially supported, prioritize what the portal should solve first, design around actual staff workflows rather than assumptions.

Concept

MVP

After validating the vision, we narrowed down the scope to define an MVP that would deliver real value without overcomplicating the rollout.

We prioritized features that would solved the most critical pain points surfaced in research and could be built and tested quickly with minimal dependency on existing systems.

Key features to deliver value:

Pre-filling data from public sources and existing accounts to reduce re-entry and improve trust

Displaying relevant pre-qualifications and refinance suggestions tailored to each member

Creating clean, linear workflows that only ask for what’s necessary—nothing more, nothing less

By visualizing the full flow, we were able to identify bottlenecks, remove unnecessary steps, and define a clear, guided path for the MVP experience.

I started exploring multiple wireframe concepts focused on navigation. Feedback from teammates guided refinements, helping us land on a structure that felt intuitive while remaining flexible for future feature growth.

User testing

We tested the prototype with Credit Union staff to evaluate how well the experience supported their day-to-day tasks. The response was very encouraging, participants found the flows intuitive, the layout clear, and appreciated how much less effort it took to complete key tasks compared to their current tools.

Handoff

Handoff page shared with engineering, containing detailed flows, components, and edge cases. The goal was to ensure clarity, reduce back-and-forth, and make implementation as seamless as possible.

As part of this project, we created new design system foundations to support consistent and efficient UI development, not just for the Staff Portal, but for future internal tools as well.

Delivered experience

Business impacts

This rollout marked a key milestone in validating the portal's scalability and usability across geographically distributed teams. Since the portal launch, we’ve consistently seen around 200 funded loans per month, significantly streamlining the lending process.

We reduced the average time to submit and fund loans

Empower staff with intuitive workflows that minimized training time

Improve accuracy in application intake

Follow-up features

NEXT PROJECT

Designed a personalized credit experience through risk segmentation, creating tailored flows for different profiles.